Get Best Mortgage Deals

We have access to over 70+ different mortgage lenders,

Get expert advice from Visionary Finance

There’s sometimes a little confusion around what a mortgage broker actually does. So, what are the advantages of using a mortgage broker? Read more as we break down how a mortgage broker supports you during the mortgage process.

Getting a mortgage can be one of the largest financial decisions a person can make in their lives, so getting it right is essential.

Speaking to a mortgage broker as early as you can in the mortgage process is essential. This is because you need to have a good understanding of the maximum lending amount you could be offered and what schemes there are out there to assist you on your journey to homeownership. An independent mortgage broker like Visionary Finance has whole market access to over 70 different lenders ranging from high-street banks to more specialist lenders.

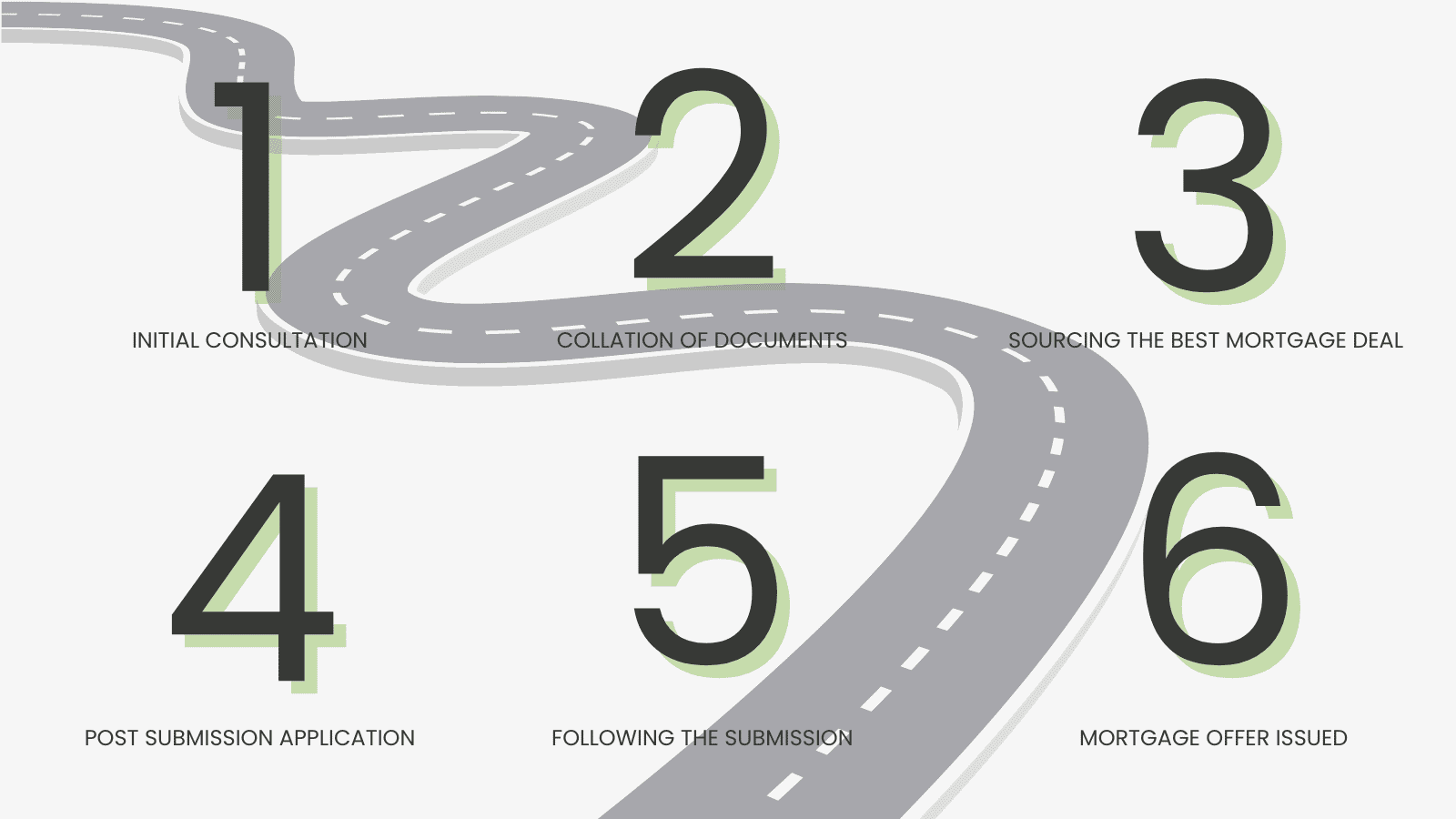

Let’s break down a step-by-step guide as to how the brokers at Visionary Finance work.

We aim to provide a seamless process when buying your new home by taking away the strain of what can be a stressful time. This process allows us to ensure we get it right the first time and offer a product that meets your unique needs.

There are a lot of benefits of using a mortgage broker. Our team of dedicated brokers and administrators are experienced in working with clients for all kinds of different mortgage products. Here are our top five benefits of using a mortgage broker.

Speaking to a broker with whole market access is the ultimate time saver. If you were to shop around from lender to lender, you will have to dedicate time from the few hours you have going spare around your daily life.

Our brokers source and apply for mortgages daily. They have excellent knowledge of where the best rates can be sourced based on your individual circumstance.

Working with us, we’ll prioritize finding the best mortgage solution for you. We’re experts in our field and don’t charge our UK-based clients any broker fees! So not only will you be sourced the most affordable mortgage based on your needs, but we’ll also keep costs down by not charging any additional fees for advice or services.

All of our brokers have the relevant certifications to allow them to legally offer mortgage advice. Visionary Finance is regulated by the Financial Conduct Authority (FCA) and we have an in-house compliance team to ensure best practices are always followed.

As part of our service at Visionary Finance, our team of protection advisers take the time to understand your unique needs and circumstances, so that they can provide you with the most suitable protection solutions in the most cost-effective way.

The team at Visionary Finance are dedicated to offering a high-level service to each of our clients. Our team of highly-experienced administrators will work with your chosen lender from start to end to ensure a smooth and stress-free journey to homeownership. Once your mortgage is in place and you’re nearing the end of your fixed-rate period, our team will be in touch to discuss remortgaging or product transfers to ensure you’re getting the most for your money.

Providing our clients with the best possible service is at the heart of what we do, we are completely independent with access to over 70 different lenders ranging from high-street banks to more specialist lenders.

Contact us for a no-obligation consultation.

Visionary Finance is a free mortgage broker based in Milton Keynes.

Mortgage Calculator

Mortgage Calculator

We have access to over 70+ different mortgage lenders,

Get expert advice from Visionary Finance