A Guide to the Mortgage Process

This is the process we use for all of our customers to ensure we get it right the first time and offer a product that meets your unique needs.

Our aim is to provide a seamless process when buying your new home by taking away the strain of what can be a stressful time.

Initial Mortgage Consultation

One of our experienced mortgage advisers will arrange an initial consultation with you to discuss your circumstances

Gathering Your Documents

Typically this would include a personal factfind, identification, income verification, address verification and credit reports

Researching The Mortgage Market

Visionary Finance explore mortgage products available to you by discussing your needs with our range of lenders

Applying For Your Chosen Mortgage

Once a suitable lender and mortgage product have been found, the formal mortgage application process is started

Managing Your Mortgage Application

Our mortgage administration team will be in regular contact with the lender to guide your case through to mortgage offer

Mortgage Offer Issued

Once all the lender and underwriting requirements have been satisfied, an offer will be sent to you and your solicitor so the legal process can be completed

SIX STEPS TO SUCCESS

Why Work With Us?

By letting us manage your mortgage matters, you can spend more time doing what you enjoy.

HOW WE DO THINGS

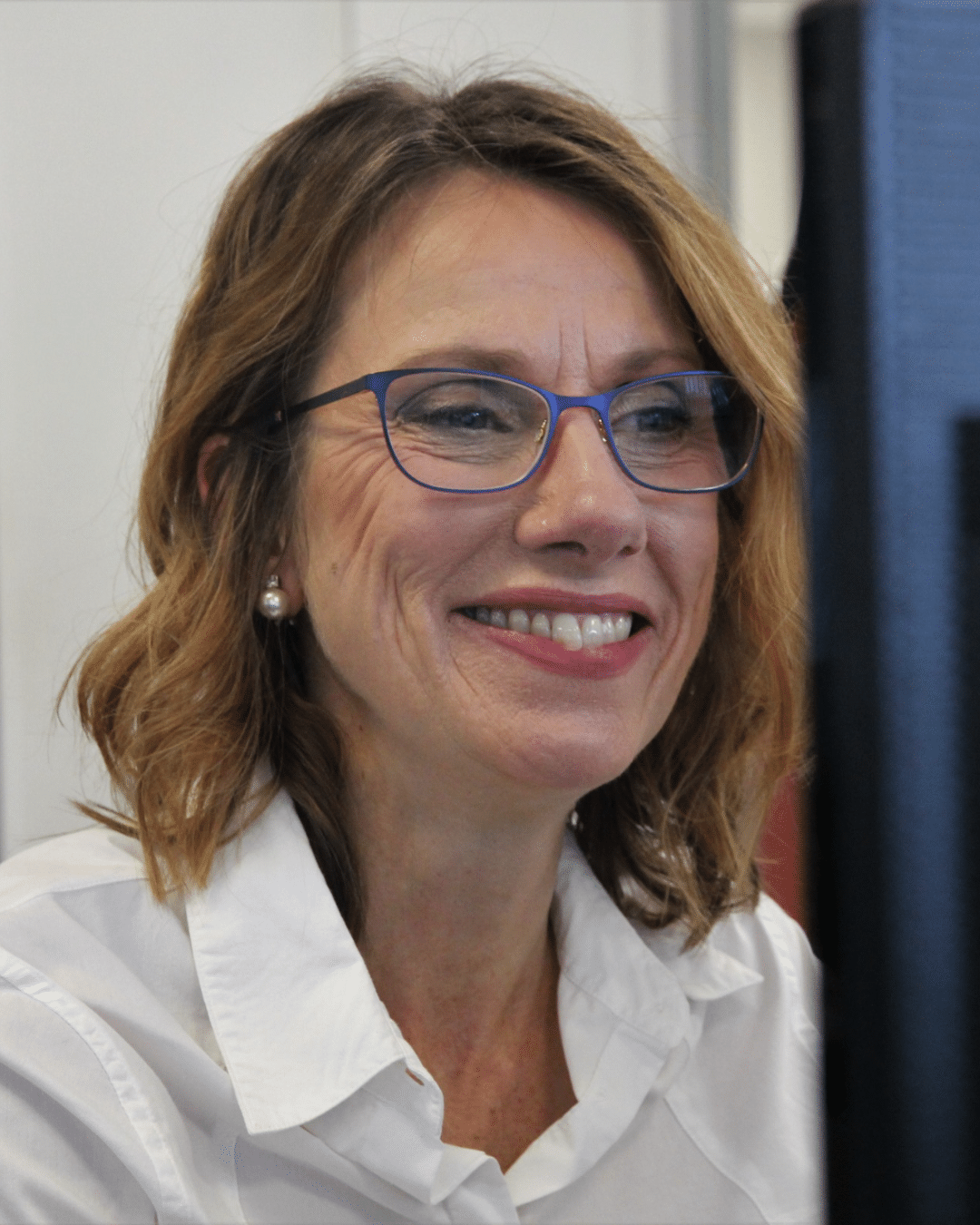

Our Commitment to our Clients

Our clients are at the forefront of what we do and how we do it. The following are promises that our customers and partners can expect when working with us.

Mortgage FAQs

Find answers to commonly asked questions about the UK mortgage process.

If you can't find the answer to your question or want to find out more, get in touch. One of our mortgage advisers would be more than happy to help.

How can I apply for a mortgage with Visionary Finance?

Our mortgage advisers will manage the entire mortgage process for you, from start to finish. After a free initial consultation, we'll gain a greater understanding of you and your circumstances. From there we'll be able to research the market and offer the best mortgage advice based on your requirements.

How can I arrange life insurance?

Visionary Finance can arrange life insurance for you. Our team of insurance and protection advisers will help you to get it right. We're here to help you choose the right protection and most appropriate level of cover.

How will my mortgage application be managed?

When starting the mortgage process with Visionary Finance, you will be allocated a dedicated mortgage adviser and mortgage administrator. We'll keep you informed of any updates with your mortgage application and maintain regular contact to make the mortgage process smooth and stress-free for you.

What are the benefits of using a mortgage adviser?

We'll manage your mortgage requirements so you can spend more time doing what you love. Our team of expert mortgage advisers will put your needs first. Let us take away the stress of the mortgage process.