Get Best Mortgage Deals

We have access to over 70+ different mortgage lenders,

Get expert advice from Visionary Finance

Navigating the realm of buy-to-let mortgages demands astute financial comprehension in the dynamic landscape of property investment. To make informed decisions, aspiring landlords and seasoned investors must grasp the intricacies of rental yield and return on investment (ROI). At Visionary Finance, we’re committed to empowering investors with the knowledge needed to thrive in the buy-to-let market. In this comprehensive guide, we explore buy-to-let mortgage affordability. We unravel the complexities of rental yield and ROI calculation.

Buy-to-let mortgages are specifically designed for individuals seeking to purchase properties to rent them out to tenants. Unlike residential mortgages, buy-to-let mortgages are assessed based on the potential rental income of the property rather than the borrower’s personal income.

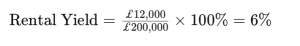

Rental yield is a critical metric for evaluating the profitability of a buy-to-let property. It is calculated by dividing the property’s annual rental income by its purchase price, expressed as a percentage. A high rental yield signifies a lucrative investment opportunity, while a low yield may indicate potential financial strain.

For instance, if a property generates £12,000 in annual rental income and were purchased for £200,000, the rental yield would be:

While rental yield provides a snapshot of immediate returns, ROI offers a comprehensive outlook on the investment’s long-term profitability. ROI considers rental income and factors such as property appreciation, maintenance costs, and financing expenses.

Net Profit includes rental income minus expenses such as mortgage payments, property management fees, maintenance costs, and taxes.

Total Cash Investment encompasses the deposit amount, acquisition, and refurbishment costs.

Calculating ROI enables investors to assess the sustainability and viability of their buy-to-let ventures over time.

At Visionary Finance, we specialise in providing bespoke mortgage solutions tailored to your unique financial circumstances and investment objectives. Our team of seasoned buy-to-let mortgage advisors possesses the expertise and industry insights to navigate the complexities of property investment with confidence and clarity.

Whether you’re a first-time homebuyer venturing into buy-to-let investment or a seasoned landlord seeking to expand your property portfolio, Visionary Finance is here to guide you every step of the way. Contact us today to embark on your journey to financial prosperity and real estate success.

Contact Visionary Finance for personalised buy-to-let mortgage advice and tailored financial solutions.

Mastering buy-to-let mortgage affordability requires a deep understanding of rental yield and ROI, which are crucial for successful property investment. By leveraging this knowledge and adopting sound financial strategies, investors can unlock the potential of the buy-to-let market. This approach allows for significant returns and long-term wealth. Trust Visionary Finance to be your steadfast partner in navigating the complexities of buy-to-let mortgages and achieving your investment aspirations.

Mortgage Calculator

Mortgage Calculator

We have access to over 70+ different mortgage lenders,

Get expert advice from Visionary Finance