Get Best Mortgage Deals

We have access to over 70+ different mortgage lenders,

Get expert advice from Visionary Finance

A mortgage is one of the most expensive financial commitments an individual can make in their lifetime. With the cost of living crisis and interest rates expected to increase, should homeowners consider remortgaging?

Money Saving Expert founder, Martin Lewis, warned homeowners that they should prepare in advance and remortgage now to try and avoid higher interest rates.

When asked about fixing a new mortgage when their current product expires, Lewis said:

“Now if you look at the impact on mortgages, six months ago you could get mortgage deals below 1%, mortgage fixes below 1%, the cheapest fixes are now double that at 2.1%.

“So, the cost of getting a mortgage is going up. And if I’m honest I have some real concerns about mortgages right now. This is the concern, we’re seeing rates go up, but you also have to remember to get a mortgage to be accepted, you have to pass a credit check and an affordability check.

“And an affordability check examines “have you got room to pay this mortgage”.

“Now we are clearly in the midst of a cost of living crisis. So everybody has less room than they did before because other costs have gone up.

“So, my great fear is we’re seeing interest rates go up and fewer people are going to be accepted when they apply for a mortgage because more are going to fail affordability checks.

“And that leaves us with a ticking time bomb because most people are on cheap fixes and they’re going to expect to fix again on the cheap rate and it’s going to be a lot higher, and they may not be able to get them and that is a real problem coming forward.’

“So, if you’re coming to the end of your rate, you need to prepare in advance.

“You might even want to pay a booking fee to lock in a cheap mortgage in case things get more expensive and if it doesn’t you can get a cheaper one elsewhere, so it’s like an insurance policy so you lose a few hundred quid having locked in a cheap mortgage. Speak to a mortgage broker for help.

“As for a two or 5-year deal? Well, if things are going up and you want certainty and you can get a cheap five-year deal, a five-year deal gives you certainty.”

Mortgage Brokers and Financial Advisers were quick to respond to Lewis’s claims broadcasted to over 2 million people at home.

Managing Director of Visionary Finance, Hiten Ganatra, said:

“Martin Lewis is a champion for money-saving advice and has been an undeniable force for consumer rights. But his passion seems to have him accidentally provoking panic in the public. Martin is right, you should prepare in advance, consulting a qualified mortgage adviser will give you a greater understanding of where and how you can save money on your mortgage.”

Now is a good time to remortgage if your fixed term is coming to an end in the next 6 months. You may consider remortgaging if you are on your lender’s standard variable rate (SVR) and would like to fix your mortgage payments.

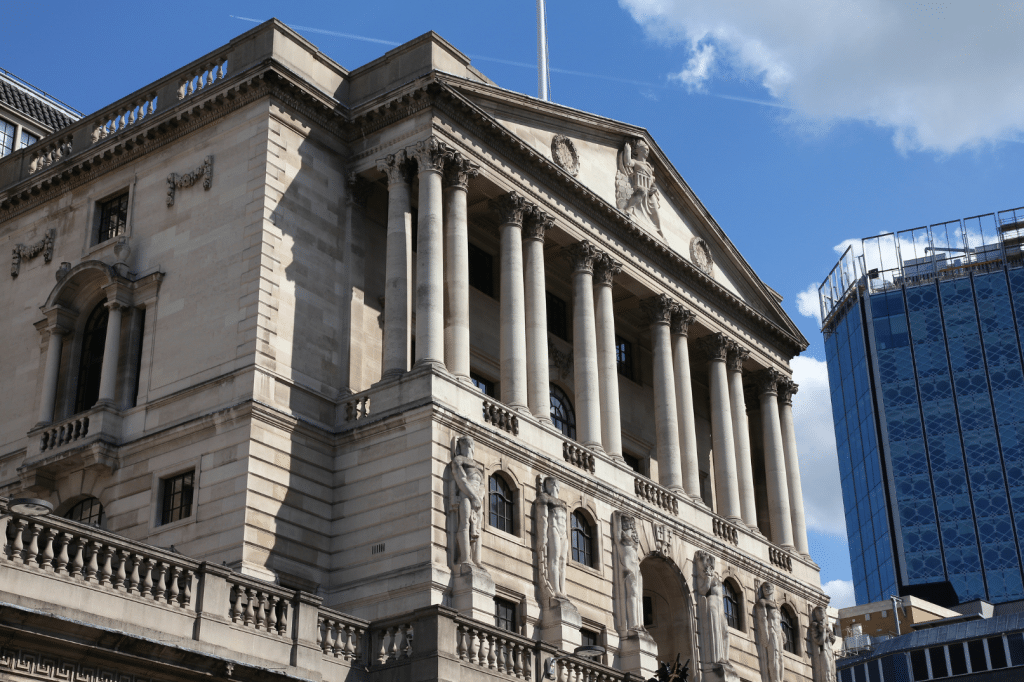

At the beginning of the month, the Bank of England increased base rates to 1% from 0.75% after the Monetary Policy Committee (MPC) voted in favour of an increase for the fourth time since December 2021. Although this may sound alarming to some, UK interest rates have been at historically low levels for several years.

Many advisers believe we will be seeing the base rate reach levels of 1.25% by the end of the year. The next MPC meeting is on the 16th of June and experts believe we are likely to see another increase.

Remortgaging or choosing a product transfer could save you hundreds of pounds. If you want to explore your options and save money, speaking to a mortgage adviser will give you a clearer insight into what products will suit your circumstance.

Providing our clients with the best possible service is at the heart of what we do. We are a completely independent mortgage brokerage with access to over 70 different lenders. Get in touch for your free initial consultation.

Mortgage Calculator

Mortgage Calculator

We have access to over 70+ different mortgage lenders,

Get expert advice from Visionary Finance