The Help to Buy scheme is ending in 2023. Mortgage seekers will have to reserve properties by October 31st, 2022.

The help to buy scheme was first introduced in 2013 following the negative impact the financial crisis of 2008 had on the housing market. The scheme was developed to support mortgage seekers struggling to save for a deposit on a residential property. The scheme has been updated over the past decade with the most recent version launched in 2021.

How does help to buy work?

The Help-to-Buy scheme is available to first-time buyers in England, with government similar schemes available in Scotland and Wales. So far, there are no reports of a replacement scheme to be introduced with Help to Buy ending. There are other options for First-time buyers besides Help-to-Buy.

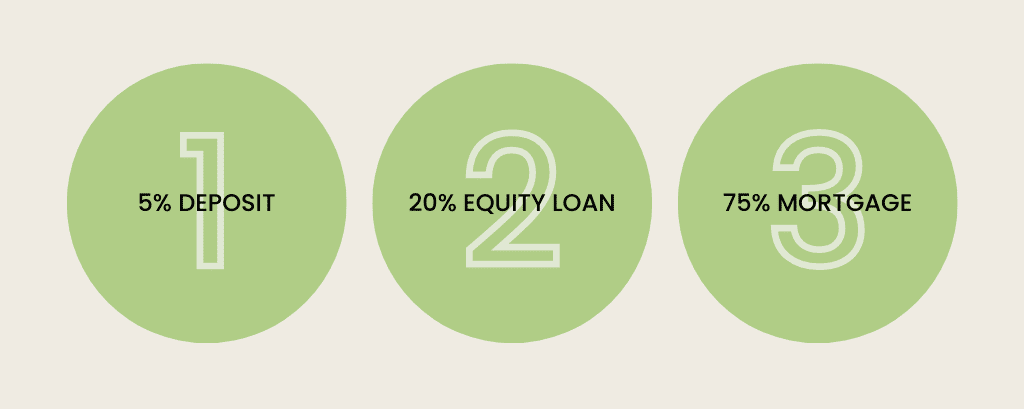

- First-time buyers will only require a 5% deposit to utilise the Help to Buy scheme

- The government will then provide the purchaser with a 20% equity loan of the full purchase price

- The remaining 75% will be paid via a mortgage from a lender

For example, a property valued at £200,000 would require a 5% deposit of £10,000. The government will provide a 20% equity loan worth £40,000 meaning the mortgage amount required from a lender would be £150,000.

The scheme has slightly different criteria in London.

Help to Buy London

- First-time buyers will only require a 5% deposit to utilise the Help to Buy scheme in London

- The government will then provide the purchaser with up to a 40% equity loan of the full purchase price

- The remaining 55% will be paid via a mortgage from a lender

In April 2021, the government amended the scheme, introducing a regional price cap to properties to ensure those who needed the scheme the most would be helped.

Help to Buy regional price caps

| North East | £186,100 |

| North West | £224,400 |

| Yorkshire and The Humber | £228,100 |

| East Midlands | £261,900 |

| West Midlands | £255,600 |

| East of England | £407,400 |

| London | £600,000 |

| South East | £437,600 |

| South West | £349,000 |

The regional price caps for help to buy are the full purchase price of the property. These prices are non-negotiable. When enquiring with a property developer or estate agent, they will be able to inform you of property prices. An independent mortgage broker will be able to enquire with mortgage lenders to assess your eligibility for the help to buy scheme.

Paying back the equity loan

The deposit you saved, your equity loan and your mortgage will cover the total cost of buying your newly built home.

For the first five years of homeownership, you will not have to pay any interest on the equity loan. However, as soon as you reach the sixth year of your mortgage, interest will be charged at a rate of 1.75%.

For example, if a property was purchased for £200,000, the equity loan would have been £40,000. The annual interest payment in year 6 (1.75% of the equity loan) is £700. Spread over a 12 month period, the monthly interest payment in year 6 would be £58.33.

To prepare in advance for the interest to be charged, it’s advisable to make part repayments of the equity loan as this will decrease the amount the interest rate is applied to, reducing the chargeable interest.

You must repay your equity loan when:

- you reach the end of the equity loan term

- you have paid off your repayment mortgage

- you decide to sell your home

If you sell your home, you’ll pay back the equity loan percentage of the market value or agreed sale price if it has increased.

Contact a free Mortgage Broker

With Help to Buy ending in 2023, and all mortgage applications required by 31st October 2022, it’s advisable to speak to a mortgage adviser to determine your mortgage affordability. If Help to Buy isn’t a viable option for you, don’t worry, speaking to an independent mortgage broker will let you know your affordability and source you a mortgage solution to get onto the property ladder. Visionary Finance is an award-winning, free mortgage brokers based in Milton Keynes. We do not charge any of our UK clients a broker fee, saving you money during the mortgage process. If you would like to find out more about Help to Buy, contact us and we’ll be in touch.